Consider how a $1,200 investment grows over time with compound interest through various investment instruments. When we use the term “compound interest” in the investing world, we’re not really even usually talking about interest but rather the gains/returns that we might receive from our investments. On the other hand, compound interest really does apply to when we’re paying it because it’s usually because we’re working to pay off some massive debt. Compound interest isn’t just a principle about money; it’s a tremendous growth activator for your mind! Like the financial growth described above, personal growth isn’t linear; it’s exponential. Just as interest makes interest, knowledge makes knowledge!

Pensions are a great example of compounding in action as the rules force us to think long term. This is because you cannot usually access your pension until age 55 at the very earliest. Basically you start to earn interest on your original deposit AND you would earn interest on the interest you have just earned. Perhaps it prevents you from signing up for a high interest credit card. Imagine that instead of $100, you saved $10,000 and earned 10% for 30 years. $10,000 for 30 years at 10% per years turns into $174,494.02.

Compound Interest – The Most Powerful Force in the Universe?

That first year you did make $500, or 10% on your $5K investment. But, in Year 2, you’re going to make 10% on your $5,500 invested rather than just the $5K that you initially put in. For the first couple years of my investing journey, I really didn’t fully comprehend what he was meaning when he said this. Of course I understood that the reason why investing can be so lucrative is because of compound interest, but what I didn’t fully get was that those that don’t understand compound interest “pay it”. A recent Huffington Post story ran about a woman celebrating her 98th year as a customer of a local bank. June Greg’s father deposited $6.11 into her account 98 years ago, when she was only two years old.

On your death, you are, for tax purposes, deemed to have disposed of your investments. Consequently, your estate is taxed on your capital gains up to that date. So, for individual stockholders, buy and hold works best if you live to be as old as Methuselah. Studies have shown that by far the most important factor is the asset class you invest in.

It is essentially the interest that has been calculated on your initial investment and your interest you have accumulated from income from previous years. So basically it is ‘interest on 10 Key Bookkeeping Tips for Self-Employed & Freelancers interest’, therefore your investment will mature at a faster rate compared to simple interest. There is, however, a limitation on how long individuals can compound their wealth tax-free.

Did Einstein ever remark on compound interest?

By the time they are 60, Investor 1 only set aside $13,000 (age 18 – 30) but Investor 2 set aside $30,000 (age 31 – 60). It showed me that something this fundamentally important bears repeating. I’ve heard more than a few coaches stress the importance of “practicing the fundamentals” in sports. Growing up, I would hear “even Magic Johnson practices dribbling and passing every day”. The same thing applies here, even if you’ve heard it before, let’s take another look at THE POWER of Compound Interest.

- This is because you cannot usually access your pension until age 55 at the very earliest.

- That first year you did make $500, or 10% on your $5K investment.

- If you want to see the math in a spreadsheet, you can view it here.

It will also allow me an opportunity to come clean on my use of this quote. When you actively read, you analyze and synthesize. Therefore critical thinking and strategic planning are simultaneous and complementary. Just like your money grows in a saving vehicle, so does knowledge when deposited into your cranial vault. Investor 1 saves $1,000 per year from age 18 – 30 – then STOPS SAVING FOREVER.

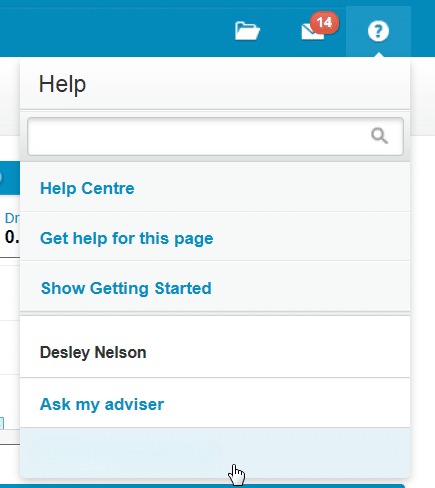

Find Your Account

If you use it to your advantage with your investments, it will make all the difference over the long term. Long term is 30, 40, or more years, not five years. Back to Albert Einstein

With such potential for astronomical growth, it’s no wonder Albert Einstein called the power of compound interest the most powerful force in the universe. The problem though, is that there is substantial doubt he actually said that. Albert Einstein is said to have called « the power of compound interest the most powerful force in the universe. » The story in this posting will illustrate the power far better than I ever could in theory.

- The compound interest effect refers to the snowball of money that grows on your behalf when you reinvest your interest.

- Even if John waits until age 25 then he need only put aside a modest £67.18 per month to reach £100,000 by 65.

- These figures are examples only and they are not guaranteed, they are not minimum or maximum amounts.

- Even with all that fanfare for the topic, I’ve been guilty of neglecting to properly cover it when discussing financial literacy.

- Now, just for fun, imagine in the above example that each period represented a year instead of a day.

- Albert Einstein is said to have called « the power of compound interest the most powerful force in the universe. » The story in this posting will illustrate the power far better than I ever could in theory.

After 30 years at 10%, the $100 has grown to $1,744.94. After 20 years at 10%, the $100 has grown to $672.75. And the process repeats unless the person withdraws the money.

You must log in to answer this question.

I’ve found I take for granted that I was taught the power behind compound interest at a young age. I was fortunate that I had classes that taught me these lessons as early as middle school, but not everybody is so fortunate. Once you understand what compound interest means, it can change your perspective on money and investing.

The concept is that when you earn interest in X amount of time, that next time period you’re going to earn interest on the principal AND the interest that you previously earned. Basically you’re double dipping on return on your investments. Albert Einstein once said, « Compound interest is the eighth wonder of the world. He who understands it earns it; he who doesn’t pays it ». While some people question whether the quote was, in fact, from Einstein, the power of compound interest is unquestionable. If you change some of the key factors I.E. the interest rate or the number of years you hold the investment for your savings will increase. So basically the longer you leave your savings and don’t be tempted to touch them, then overtime the ‘compounding interest’ will increase.

The difference in required savings between each of the start dates is how much of the £100,000 is taken care of by your accumulating interest payments. The chart shows how much John needs to put away to reach his goal depending on how soon he starts saving. We assume an annual growth rate of 5%, which is quite conservative by the standards of the last 40 years. Imagine that an investor, we’ll call him John, he wants to save up a retirement fond of £100,000 by the time he retires at age 65. Essentially, the more time you have to invest the more you benefit from compound growth.

Now if you are like most people, at first you might jump on the million dollar deal. But if you break out your calculator and double one penny for 30 days you will be amazed that on day 30 your penny would be worth over $5,000,000. You can email the site owner to let them know you were blocked. Please include what you were doing when this page came up and the Cloudflare Ray ID found at the bottom of this page.

Even better, every single investor can profit from “man’s greatest invention”, not just geniuses or billionaires. If you know a younger person putting off starting a pension, or unsure about whether to invest more into one, I hope I have given you sufficient reason why they should not delay. If you know anyone with children or grandchildren, the same applies. It is now possible to start a pension from the day you are born!

I will be eternally grateful for his parental persistence for decades to come. Tax Relief combined with compounding over a very long term is a very powerful combination indeed and can produce some staggering results. Which basically means that by grasping compound interest you have the determination and the motivation to achieve your goals, by making your money work more effectively for you. If you borrow money the same concept does not work in your favour, but works in the favour of the lender. He wasn’t known for his investing abilities, but he did identify the most amazing mathematical revelation known as ‘compound interest’. Albert referred to it as the eight wonder of the world.